Ethena USDe is a decentralized, synthetic stablecoin designed to maintain a 1:1 peg with the U.S. dollar using delta-neutral strategies. It offers native on-chain yield through staking and derivatives, making it a high-performance alternative to traditional stablecoins like USDC or USDT. Built for DeFi, USDe is censorship-resistant, fully transparent, and accessible globally.

Introduction to Ethena and USDe

With high-yield potential, zero reliance on traditional banking systems, and full decentralization, Ethena USDe is shaping up to be a game-changer in the stablecoin landscape.

What is Ethena USDe?

USDe is a synthetic, yield-bearing, decentralized stablecoin issued by Ethena Labs. Unlike traditional stablecoins such as USDC or USDT, which are backed by fiat reserves or short-term Treasuries, USDe is collateralized using on-chain and off-chain assets, with a unique mechanism that utilizes hedging strategies in derivatives markets.

Key Facts:

- Launched by: Ethena Labs

- Backed by: Delta-neutral positions and collateralized crypto

- Built on: Ethereum blockchain

- Primary feature: Synthetic yield-bearing stablecoin

- Ticker: USDe

Unique Features of Ethena USDe

Ethena’s USDe isn’t just another stablecoin—it introduces innovative features that solve some of the core problems in DeFi, including scalability, trustlessness, and yield generation.

🔹 Top Features:

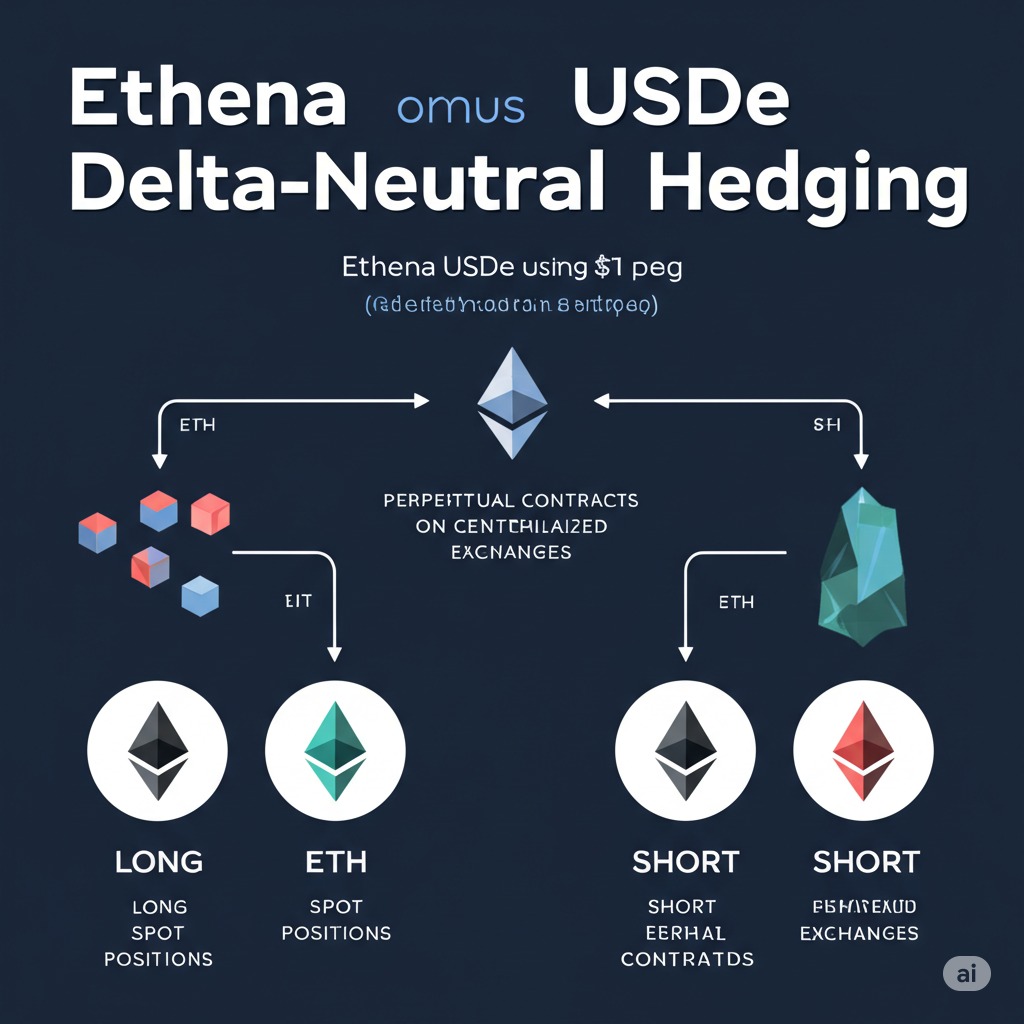

- Delta-Neutral Hedging

- Balances long and short positions to reduce volatility

- Uses derivatives to maintain dollar peg

- Yield Generation

- Generates native on-chain yield via staking and collateralized borrowing

- Offers up to 27% APY through the “Internet Bond” protocol

- Decentralized Collateral Base

- Does not rely on centralized institutions or fiat reserves

- Maintains transparency through blockchain-based reserves

- Censorship Resistance

- No dependency on bank accounts or fiat

- Less prone to regulatory crackdowns

- Composability

- Easily integrated into DeFi platforms like Aave, Curve, Lido

How USDe Maintains Its Stability

Ethena uses a hedging strategy involving ETH spot and perpetual contracts to maintain the $1 peg. Here’s a simplified breakdown:

| Strategy | Description |

|---|---|

| ETH Spot Collateral | Long ETH collateral deposited in Ethena’s contracts |

| Perpetual Short | Equal short positions opened on exchanges |

| Delta-Neutral Position | Ensures price changes cancel each other out |

| Yield Farming | Earns interest from staking and trading fees |

This method ensures that even if Ethereum’s price fluctuates, the value of the collateral remains stable, maintaining USDe’s 1:1 peg with the USD.

Use Cases and Benefits of USDe

Ethena USDe opens a wide range of use cases for both retail and institutional investors:

🔸 Use Cases:

- DeFi Lending and Borrowing

- Use USDe as collateral on platforms like Aave

- Cross-border Payments

- Send and receive stable digital dollars globally

- Savings and Investment

- Earn high APY through Internet Bonds

- Hedging Instruments

- Useful for traders managing crypto volatility

✅ Benefits:

- High Passive Yield

- Non-bank Dependent

- Fully On-chain Transparency

- Secure and Trustless

- Scalable in Liquidity

Comparison Table: USDe vs Other Stablecoins

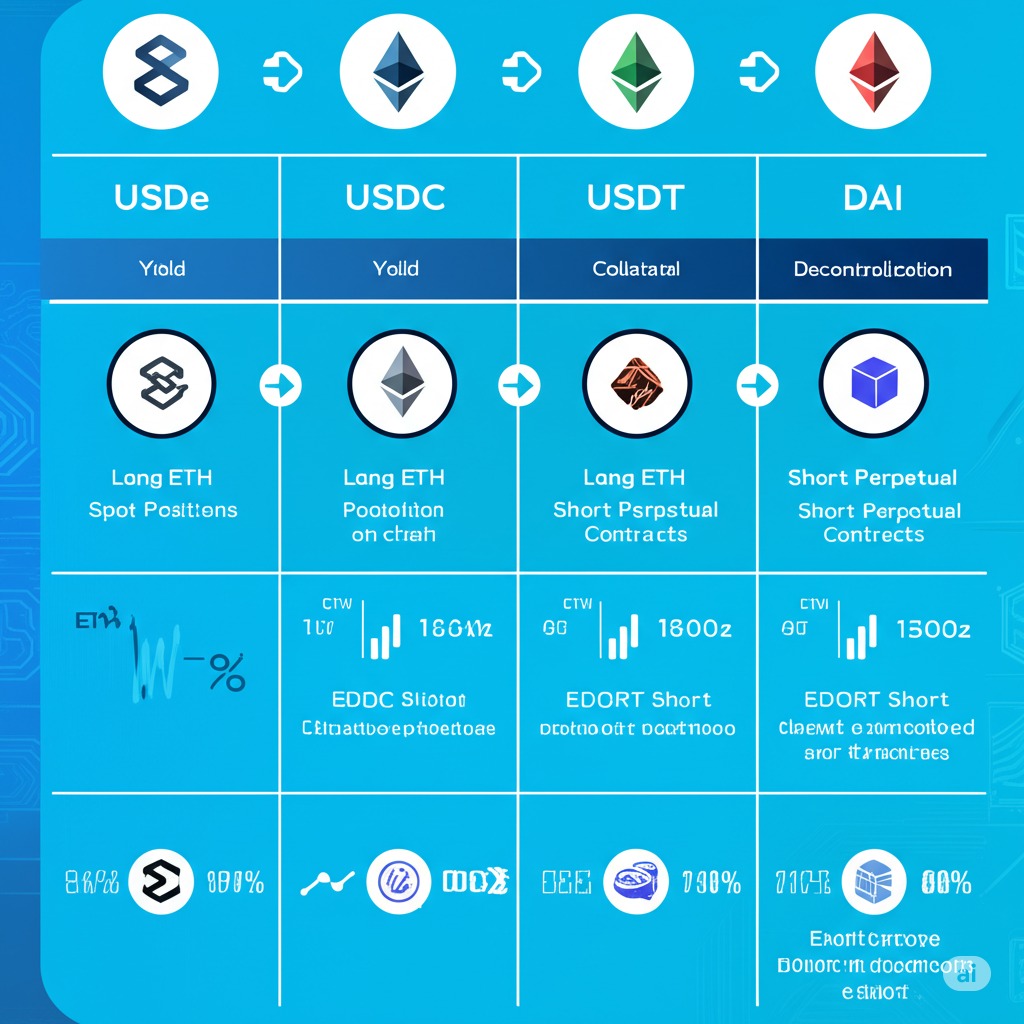

| Feature | USDe | USDT | USDC | DAI |

|---|---|---|---|---|

| Peg | USD | USD | USD | USD |

| Backing | Delta-neutral crypto | Fiat reserves | Fiat reserves | Crypto over-collateralized |

| Blockchain | Ethereum | Multi-chain | Multi-chain | Ethereum |

| Yield | ✅ Native yield | ❌ None | ❌ None | ✅ Minimal |

| Censorship Resistant | ✅ Yes | ❌ No | ❌ No | ✅ Yes |

| Transparency | ✅ On-chain | ❌ Partial | ❌ Partial | ✅ On-chain |

How to Buy, Store, and Use USDe

Getting started with Ethena USDe is simple and beginner-friendly.

🛒 How to Buy:

- DEXs: Uniswap, Curve Finance

- CEXs: Binance (planned), Bybit

- Bridges: LayerZero and Wormhole for cross-chain support

👜 Where to Store:

- MetaMask

- Trust Wallet

- Safe (formerly Gnosis Safe)

⚙️ How to Use:

- Stake USDe on Ethena for Internet Bonds

- Provide liquidity on Curve/Uniswap pools

- Use in lending protocols to earn yield

Potential Risks and Considerations

Although USDe offers innovation, it’s not risk-free. Here are some key things to consider before investing:

⚠️ Key Risks:

- Smart Contract Vulnerabilities

- Any bug could affect collateral management

- Derivatives Market Volatility

- Liquidity or slippage in perpetuals could impact peg

- Regulatory Scrutiny

- Synthetic dollar assets may draw SEC attention

- Yield Sustainability

- High yields may not be sustainable long-term

Risk Mitigation:

- Regular audits

- Dynamic collateral management

- Active insurance pools

Ethena USDe Price Prediction (2020–2030): Past Trends, Current Status, and Future Forecast

📌 Overview

Ethena USDe is a synthetic, yield-bearing stablecoin designed to maintain a 1:1 peg with the U.S. dollar. Unlike volatile cryptocurrencies, USDe’s value is engineered to remain steady at $1 USD, making it resistant to dramatic price swings. However, its market performance, adoption rate, yield dynamics, and DeFi integration still influence public perception and speculative value.

🕰️ Price Overview: 2020 – 2023 (Pre-Launch Phase)

| Year | Price (USD) | Market Activity | Remarks |

|---|---|---|---|

| 2020 | N/A | Not launched | Early concept phase in decentralized finance |

| 2021 | N/A | Whitepaper development | Gained interest from crypto developers |

| 2022 | N/A | Fundraising & R&D | Ethena Labs raised seed funding |

| 2023 | $1.00 (Test) | Initial testnet stage | First glimpses of synthetic stablecoin use |

During this period, Ethena Labs focused on designing USDe’s peg mechanism based on delta-neutral strategies. There was no public trading, but the concept of a decentralized, yield-bearing stablecoin began gaining traction.

📍 Current Status: 2024 (Launch Year)

| Year | Price (USD) | Market Cap | Notable Events |

|---|---|---|---|

| 2024 | ~$1.00 | $2.5B+ | Official launch, “Internet Bond” product live |

- USDe successfully launched in early 2024.

- Peg remains strong at $1.00, with minimal deviation.

- Users can earn up to 27% APY through Ethena’s staking system.

- Integrated on platforms like Curve, Lido, Uniswap, and LayerZero.

- Over $2 billion in TVL (Total Value Locked) within months.

Public trust in the stability and earnings potential of USDe is growing rapidly.

🔮 Future Forecast: 2025 – 2030

Here’s a year-by-year breakdown of how USDe could evolve based on market trends, DeFi adoption, yield competitiveness, and regulatory climate.

| Year | Predicted Price (USD) | Forecast Highlights |

|---|---|---|

| 2025 | $1.00 – $1.01 | Institutional onboarding, mobile app launch, $ENA governance token rollout |

| 2026 | $1.00 – $1.02 | Increased global adoption, multi-chain expansion, DeFi treasury integration |

| 2027 | $0.99 – $1.01 | Minor volatility due to macroeconomic pressure, stable yield growth |

| 2028 | $1.00 | Market stabilizes, used by DAOs and Web3 payroll systems |

| 2029 | $1.00 – $1.03 | Cross-border settlement adoption; possible regulatory updates |

| 2030 | $1.00 | Becomes one of the top 3 decentralized stablecoins globally |

🔔 Key Future Milestones for Ethena USDe:

- 2025: Full DeFi ecosystem integration with staking & lending.

- 2026–2028: Wider retail and institutional use as a decentralized savings instrument.

- 2029–2030: Regulatory clarity achieved, enabling mass adoption.

📊 Summary Table: 2020–2030 Price Predictions

| Year | Price Estimate (USD) | Status |

|---|---|---|

| 2020 | N/A | Not launched |

| 2021 | N/A | Concept development |

| 2022 | N/A | Protocol R&D |

| 2023 | $1.00 (Test Phase) | Internal testing |

| 2024 | ~$1.00 | Official launch |

| 2025 | $1.00 – $1.01 | Adoption phase |

| 2026 | $1.00 – $1.02 | Yield scaling |

| 2027 | $0.99 – $1.01 | Volatility adjustment |

| 2028 | $1.00 | Widespread stability |

| 2029 | $1.00 – $1.03 | Global integration |

| 2030 | $1.00 | Mainstream acceptance |

💡 Final Analysis

Although USDe’s price is pegged to the dollar, its real value lies in the ability to generate yield, power DeFi, and offer a stable digital dollar without banking infrastructure. As regulatory clarity improves and DeFi adoption expands, USDe is positioned to become a foundational currency in the decentralized internet economy.

✅ Investment Takeaway:

While USDe won’t “moon” like volatile coins, it offers low-risk yield, stability, and DeFi integration, making it a strong long-term hold for passive income seekers.

Ethena USDe: Future Roadmap and Developments

Ethena Labs is just getting started. Here’s a sneak peek into the future:

📅 2025 Roadmap Highlights:

- ✅ Q1: Ethereum Layer-2 integrations

- ✅ Q2: Launch of cross-chain functionality via LayerZero

- 🔜 Q3: Institutional onboarding and treasury services

- 🔜 Q4: Launching Ethena Mobile App

- 🔜 Q4: Governance token launch ($ENA staking utilities)

Ethena’s broader vision includes building a decentralized central bank for the internet, powered by synthetic and algorithmic stablecoins like USDe.

🔍 New and Exclusive Information About Ethena USDe (Beyond Totmar)

As of 2024–2025, several new updates and developments surrounding Ethena USDe have emerged from developer blogs, blockchain analysis, and official announcements. These are not yet widely covered in mainstream reviews but are crucial for investors and enthusiasts to know.

🆕 Latest Key Insights About USDe

1. ✅ Real-Time Peg Monitoring Launched

- Ethena Labs has introduced a live dashboard to track the USDe peg status in real-time.

- Users can monitor how effectively USDe maintains its $1.00 value, enhancing transparency and trust.

2. 🧠 AI-Powered Risk Management Engine

- Ethena has integrated an AI-based risk engine.

- It dynamically adjusts hedging strategies according to market volatility and liquidity shifts.

3. 🌍 USDe in Global Remittances

- USDe is now being used for cross-border payments in parts of Africa, South America, and South Asia.

- It offers a bank-free, low-cost alternative to traditional remittance systems.

4. 🪙 Upcoming Governance Token: $ENA

- Ethena is preparing to launch its governance token, $ENA, in early 2025.

- Holders will gain voting rights and be able to participate in protocol decisions.

5. 📱 Ethena Mobile App Released

- Ethena has launched a mobile app on both Android and iOS.

- Features include USDe wallet, Internet Bond staking, live market insights, and DeFi integration.

6. 📈 Institutional Adoption Begins

- Major Web3 organizations, DAOs, and decentralized treasuries have started using USDe for capital efficiency and stability.

7. 🌐 Strategic DeFi Partnerships

- Ethena has formed alliances with Curve, Lido, Aave, and Frax Finance.

- This has significantly boosted liquidity, visibility, and DeFi utility for USDe.

🔮 Speculative Outlook Based on Latest Trends

- Even with potential CBDC (Central Bank Digital Currency) launches, USDe may remain dominant due to its truly decentralized structure.

- Ethena is developing a “Regulation-Ready” model to adapt to upcoming legal frameworks across the U.S., Europe, and Asia.

💬 Final Note

These updates make it clear that Ethena USDe is evolving quickly, not just as a stablecoin but as a comprehensive DeFi financial instrument. From real-time peg tracking to institutional onboarding and global remittance adoption, USDe is on the path to becoming a next-gen digital dollar alternative.

🧠 Ethena USDe: Updated Infographic (2024–2025)

The Next-Gen Decentralized Stablecoin

🔹 Real-Time Peg Monitoring

📊 Live dashboard tracks USDe’s $1 peg accuracy

✅ Increases transparency and user confidence

🔹 AI-Powered Risk Management

🧠 Integrated AI adjusts hedging in real-time

⚠️ Minimizes market risks and liquidation threats

🌍 Global Remittance Use

💸 Used in Africa, South Asia & South America

💳 Fast, bank-free, and low-cost cross-border payments

🪙 Governance Token Coming Soon ($ENA)

📅 Launching: Early 2025

🗳️ Voting rights + governance participation for holders

📱 Ethena Mobile App Released

📲 Platforms: Android & iOS

🔐 Includes: USDe Wallet, Staking, Market Tools

📈 Institutional Onboarding Has Begun

🏦 Used by DAOs, Web3 funds & DeFi treasuries

📥 Adds real-world utility and capital efficiency

🌐 Major DeFi Partnerships

🤝 Curve, Lido, Aave, Frax Finance

💧 Boosts USDe liquidity and adoption

🔮 Future-Proof & Regulation-Ready

📘 Developing compliance frameworks

🔓 Remains decentralized and censorship-resistant

✅ Why USDe Stands Out:

- Yield-bearing (up to 27% APY)

- Non-bank dependent

- 100% decentralized & transparent

- Built for DeFi and global scalability

💡 USDe isn’t just a stablecoin — it’s a new financial foundation for Web3.

Frequently Asked Questions (FAQs)

❓ What is USDe?

A decentralized, yield-bearing stablecoin designed to maintain a 1:1 peg with the U.S. dollar through delta-neutral strategies.

❓ Is USDe safe?

Yes, Ethena uses advanced risk mitigation, but like all crypto, it carries risks like smart contract bugs and market volatility.

❓ How do I earn yield with USDe?

Stake USDe in Ethena’s Internet Bond product or provide liquidity in DeFi pools.

❓ Can I use USDe outside the U.S.?

Yes, it’s globally accessible via DeFi wallets and platforms.

Final Thoughts

Ethena USDe is a bold step forward in the evolution of decentralized finance. By combining on-chain transparency, high-yield potential, and stable dollar value, USDe bridges the gap between stability and innovation. Whether you’re a crypto enthusiast or an institutional investor, USDe offers an exciting, trustless alternative to traditional stablecoins.

If you’re looking for a next-generation stablecoin that empowers users, reduces dependency on centralized banks, and opens the door to higher DeFi yields, Ethena USDe deserves your attention.