Uniswap is a leading decentralized cryptocurrency exchange (DEX) built on the Ethereum blockchain. It allows users to trade ERC-20 tokens directly from their wallets without relying on a centralized authority. Using an automated market maker (AMM) model, Uniswap enables fast, permissionless token swaps and allows anyone to provide liquidity and earn fees. Launched in 2018, Uniswap has become a cornerstone of the DeFi (Decentralized Finance) ecosystem, empowering users with full control over their digital assets.

1. Introduction to Uniswap

As cryptocurrency adoption accelerates globally, decentralized exchanges (DEXs) are reshaping the financial landscape. At the forefront of this revolution is Uniswap, an Ethereum-based protocol that allows seamless crypto trading without intermediaries. Built on the principles of transparency, security, and decentralization, Uniswap has become a cornerstone of the Decentralized Finance (DeFi) movement.

With millions of users and billions of dollars in daily volume, Uniswap is more than a trading platform—it’s a transformative financial tool redefining how digital assets are exchanged.

2. What Is Uniswap and How Does It Work?

Uniswap is a decentralized exchange protocol that operates on the Ethereum blockchain. Unlike traditional exchanges that use order books, Uniswap utilizes an Automated Market Maker (AMM) model.

How AMMs Work:

- Liquidity is provided by users who deposit an equal value of two tokens into a pool (e.g., ETH/USDC).

- The price of tokens is determined by a formula:

x⋅y=kx \cdot y = kx⋅y=k

wherexandyare the quantities of two tokens, andkis a constant. - Swaps are executed directly from liquidity pools.

Core Mechanisms:

- Smart Contracts automate transactions.

- Liquidity Pools replace traditional market makers.

- Permissionless Listing: Anyone can create or trade a token pair.

3. Key Features of Uniswap

Uniswap distinguishes itself with several innovative features:

| Feature | Description |

|---|---|

| Decentralized | No third party controls user assets. |

| Non-Custodial | Traders retain full control of their private keys. |

| Open-Source | Anyone can audit or fork the code. |

| Interoperable | Works with any ERC-20 token. |

| Community Governance | Holders of the UNI token propose and vote on changes. |

| High Liquidity | Billions in daily volume from global liquidity providers. |

4. Benefits of Using Uniswap

Using Uniswap offers several advantages, particularly for both novice and experienced cryptocurrency users:

For Traders:

- Instant swaps of ERC-20 tokens

- No KYC or account creation

- Transparent pricing with no hidden fees

For Liquidity Providers:

- Earn a portion of the 0.3% trading fee

- Passive income opportunity with minimal effort

- Access to early-stage tokens with high upside potential

For Developers:

- Easily integrate Uniswap’s smart contracts

- Launch new tokens with liquidity instantly

5. Risks and Challenges

While Uniswap has numerous benefits, it’s important to understand its limitations:

1. Impermanent Loss

Liquidity providers risk losing value compared to holding the assets separately, especially during volatile markets.

2. Scams and Fake Tokens

Since anyone can list a token, malicious actors can create fraudulent tokens to deceive users.

3. High Ethereum Gas Fees

Uniswap operates on Ethereum, which often incurs high transaction costs. Though Layer-2 scaling solutions (e.g., Arbitrum, Optimism) are mitigating this issue, costs remain a concern.

4. Lack of Customer Support

As a decentralized protocol, Uniswap lacks centralized customer service, meaning users are responsible for their own security.

6. The Role of UNI Token

The UNI token is Uniswap’s native governance token.

Purpose of UNI:

- Participate in protocol governance

- Vote on changes such as fee structure, upgrades, or partnerships

- Receive benefits from potential future protocol revenue sharing

UNI Tokenomics:

| Detail | Description |

|---|---|

| Total Supply | 1 Billion UNI |

| Initial Distribution | 60% to Uniswap users and community |

| Governance Threshold | 1% of total supply required to submit a proposal |

| Staking | Future options may allow yield generation |

7. How to Use Uniswap: A Step-by-Step Guide

Here is a simplified process to use Uniswap effectively:

Step 1: Set Up a Wallet

- Recommended: MetaMask, Coinbase Wallet, Trust Wallet

- Ensure the wallet supports ERC-20 tokens

Step 2: Connect to Uniswap

- Visit: https://app.uniswap.org

- Click “Connect Wallet”

Step 3: Swap Tokens

- Choose tokens from dropdown

- Enter the amount to swap

- Review slippage tolerance and fees

Step 4: Confirm Transaction

- Approve in your wallet

- Wait for Ethereum network confirmation

8. Uniswap vs. Centralized Exchanges

| Feature | Uniswap | Binance / Coinbase |

|---|---|---|

| Custody | User-controlled | Exchange-controlled |

| KYC Required | No | Yes |

| Token Listing | Permissionless | Curated |

| Security | Smart contract risk | Exchange risk |

| Speed | Depends on network congestion | Usually faster |

| Fees | Network fees + swap fees | Trading + withdrawal fees |

9. Uniswap and Decentralized Finance (DeFi)

Uniswap plays a foundational role in the DeFi ecosystem:

Major Contributions:

- Liquidity Mining: Popularized yield farming

- Token Accessibility: Enabled immediate access to new tokens

- DeFi Legos: Integrates seamlessly with platforms like Aave, Compound, and Yearn Finance

Use Cases in DeFi:

- Decentralized lending and borrowing

- Flash loans and arbitrage

- Automated portfolio rebalancing

10. Future Developments and Roadmap

Uniswap is continuously evolving:

Key Updates:

- Uniswap V3: Concentrated liquidity, flexible fee tiers, improved capital efficiency

- Layer-2 Deployments: Arbitrum, Optimism for faster and cheaper trades

- Cross-Chain Compatibility: Potential integration with other blockchains like BNB Chain and Polygon

Roadmap Priorities:

- Decentralized governance enhancements

- Protocol revenue distribution to UNI holders

- Privacy-focused smart contract upgrades

🚀 1. Uniswap v4: A Developer Revolution

- “Hooks” feature lets developers plug custom logic (dynamic fees, auto-limit orders, MEV protection) directly into pools—turning Uniswap into a programmable developer platform cryptoeq.io+7blog.uniswap.org+7rocknblock.medium.com+7.

- Gas costs slashed by up to ~99.99% for pool creation, and multi‑hop swaps, thanks to flash‑accounting and singleton architecture businesswire.com+2blog.uniswap.org+2gate.com+2.

📈 2. Uniswap on Base is Booming

On Coinbase’s Base Layer‑2, Uniswap hit three consecutive monthly volume all‑time highs, reaching $15.65 billion in January 2025—driven by memecoins, AI agents, and token excitement cryptorank.io.

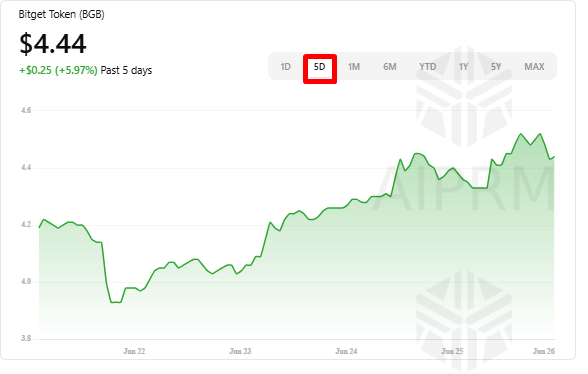

🐋 3. Whale Accumulation & Price Action

Despite UNI plunging nearly 8% (from ~$7.12 to ~$6.53) on May 30, market data suggests whale activity and anticipation around v4 are providing support blog.uniswap.org+15coindesk.com+15en.cryptonomist.ch+15.

🔒 4. Uniswap Foundation’s Strategic Boost

The Uniswap Foundation (est. 2022) recently won funding approval for the “Uniswap Unleashed” roadmap, aiming to build infrastructure and support for v4 & Unichain en.wikipedia.org+1openexo.com+1. Foundation-backed grants and DAO votes are actively shaping big protocol upgrades.

🤖 5. Cutting‑Edge DeFi Research

- Researchers applied deep reinforcement learning to optimize LP strategies on Uniswap v3—boosting fee income and reducing impermanent loss businesswire.com+3gate.com+3investx.fr+3arxiv.org.

- Another study used graph theory to unearth optimal routing paths across decentralized exchanges including Uniswap, improving swap efficiency arxiv.org+1arxiv.org+1.

🎥 Deep Dive Video

Here’s a great workshop breakdown of Uniswap v4 Hooks architecture—a must-watch for devs:

🔍 Why this matters right now (June 2025):

| Aspect | Impact |

|---|---|

| Developers | v4 unlocks novel ways to build DeFi features within Uniswap—without building separate protocols. |

| LPs & Traders | Lower gas + custom hook logic = more efficient capital and swap strategies. |

| Ecosystem | Massive on‑chain volumes, whale interest & foundation support reinforce Uniswap’s dominance. |

📊 UNI Price Forecast Overview

| Year | Minimum Price | Average Price | Maximum Price |

|---|---|---|---|

| 2025 | $9.50 | $14.00 | $20.00 |

| 2026 | $13.00 | $18.00 | $25.00 |

| 2027 | $17.00 | $22.50 | $30.00 |

| 2028 | $20.00 | $28.00 | $36.00 |

| 2029 | $25.00 | $35.00 | $45.00 |

| 2030 | $30.00 | $42.00 | $55.00 |

⚠ Disclaimer: These predictions are speculative and based on current data, trends, and projections. Cryptocurrency investments are inherently risky. Always do your own research (DYOR).

🔍 Year-by-Year Analysis

📅 2025 UNI Price Prediction

- Minimum: $9.50

- Average: $14.00

- Maximum: $20.00

🔎 Factors:

- Full integration of Uniswap v3 on Layer-2 networks.

- Increased DeFi adoption.

- Ethereum scalability upgrades reducing gas fees.

📅 2026 UNI Price Prediction

- Minimum: $13.00

- Average: $18.00

- Maximum: $25.00

🔎 Factors:

- Institutional interest in DeFi protocols.

- Potential Uniswap governance upgrades.

- Broader use of UNI in staking or rewards programs.

📅 2027 UNI Price Prediction

- Minimum: $17.00

- Average: $22.50

- Maximum: $30.00

🔎 Factors:

- Enhanced interoperability (cross-chain swaps).

- DeFi becoming mainstream in developing countries.

- Wider adoption of UNI in global governance systems.

📅 2028 UNI Price Prediction

- Minimum: $20.00

- Average: $28.00

- Maximum: $36.00

🔎 Factors:

- Potential token burn mechanisms.

- Expansion into real-world asset tokenization.

- Partnerships with institutional DeFi platforms.

📅 2029 UNI Price Prediction

- Minimum: $25.00

- Average: $35.00

- Maximum: $45.00

🔎 Factors:

- DeFi replaces traditional exchange functions in some regions.

- Growth of decentralized autonomous organizations (DAOs).

- Global regulation favoring self-custody and DEXs.

📅 2030 UNI Price Prediction

- Minimum: $30.00

- Average: $42.00

- Maximum: $55.00

🔎 Factors:

- Mass DeFi adoption.

- Possible integration with AI-driven decentralized financial models.

- UNI token used as a governance tool across multiple DeFi platforms.

🟢 Is UNI a Good Long-Term Investment?

Pros:

- Pioneer in decentralized exchange technology.

- Backed by a strong developer and governance community.

- Major role in the expanding Ethereum ecosystem.

Cons:

- High competition from other DEXs (e.g., SushiSwap, PancakeSwap).

- Reliant on Ethereum network health and upgrades.

- Regulatory uncertainty in various jurisdictions.

Investor Tip: UNI may be a strong long-term asset for portfolios focused on DeFi and decentralized infrastructure. Diversification and long-term holding strategies are advisable.

12. Conclusion

Uniswap is a game-changing innovation in the world of cryptocurrency and decentralized finance. It empowers users by eliminating intermediaries, reducing friction in trading, and offering unprecedented financial autonomy. As Ethereum and DeFi continue to evolve, Uniswap is poised to remain a critical component in the future of global finance.

Whether you’re a trader, investor, or developer, understanding and leveraging Uniswap can be a strategic move in today’s fast-paced digital economy.

11. Frequently Asked Questions (FAQ)

Q1: Is Uniswap safe to use?

Yes, Uniswap’s code is open-source and has undergone extensive audits. However, users should be cautious of fake tokens and phishing scams.

Q2: Can I use Uniswap without Ethereum?

Uniswap primarily operates on Ethereum but is expanding to Layer-2 and other chains. Some compatible tokens and wallets are required.

Q3: What are the fees on Uniswap?

Standard fee is 0.3% per swap, distributed to liquidity providers. Gas fees also apply depending on network congestion.

Q4: Can I make money with Uniswap?

Yes, through providing liquidity and earning trading fees or arbitrage opportunities, but it involves risk.

Q5: Is UNI a good investment?

UNI has long-term potential due to its governance utility and role in DeFi, but like all crypto, it remains volatile.